For finance teams in construction, managing progress claims efficiently is essential to keeping a healthy cash flow. Yet 41% of teams still rely on manual tools like spreadsheets, email chains, and paper-based processes to submit and assess progress claims.

This disconnect creates three costly issues:

- Payment Delays – 29% of teams report internal bottlenecks slow approvals

- Compliance Risks – 53% struggle to meet SOPA/CCA deadlines

- Team Frustration – 37% are unsatisfied with current claim processes

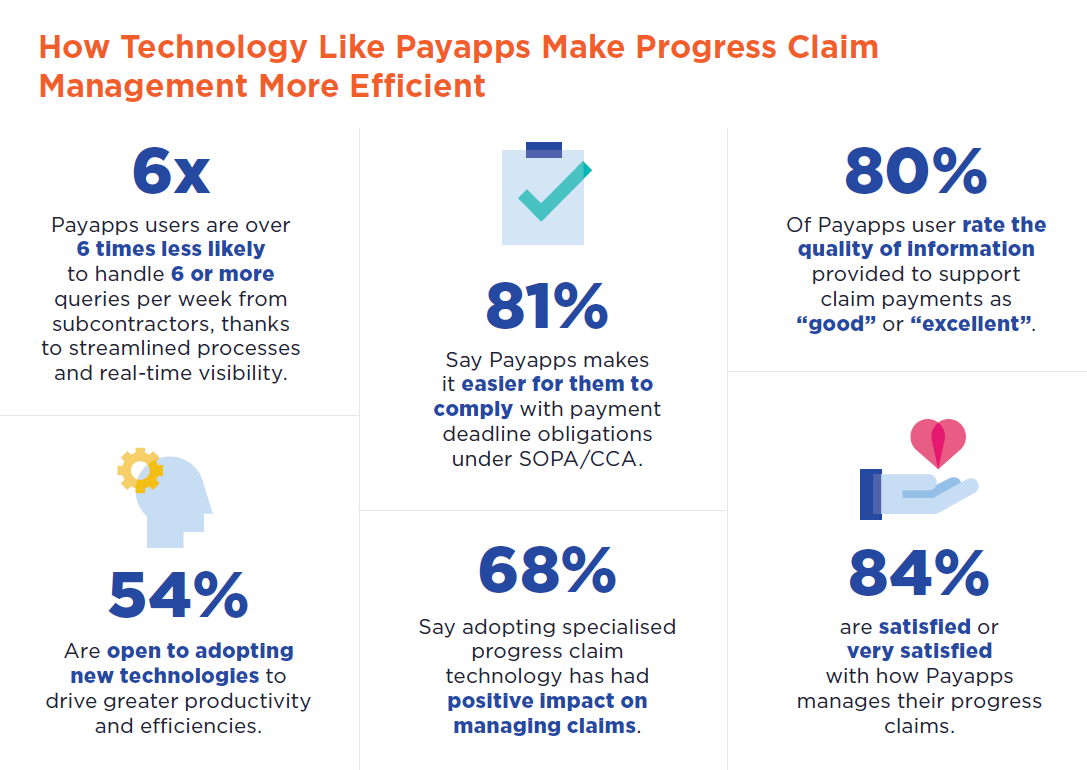

The root cause? Disconnected systems. Without using a specialised construction tool such as Payapps to connect data between construction ERPs, accounting platforms, and claim management tools, finance teams are stuck chasing data instead of driving strategic value.

How integrating your construction ERP with Payapps makes progress claims more efficient:

Eliminate Manual Data Entry and Reduce Risk

The Challenge

- 23% of teams check spreadsheets to track the status of progress claims

- 36% receive approved progress claims via email (creating version control issues)

- 44% say the quality of progress claim data “needs improvement”

How Payapps and Your Construction ERP Work Better Together

Payapps connects directly to construction ERPs (like Jobpac, Viewpoint) and accounting software (Xero, MYOB), ensuring:

- Single source of truth – No rekeying between systems

- Real-time updates – All teams see the same progress claim status

- Fewer errors – Automated validation reduces overbilling risks

Ensure SOPA/CCA Compliance Without the Stress

The Challenge

- 26% of teams rarely/never see payment deadlines

- 53% find it hard to comply with SOPA/CCA terms

How Payapps and Your Construction ERP Work Better Together

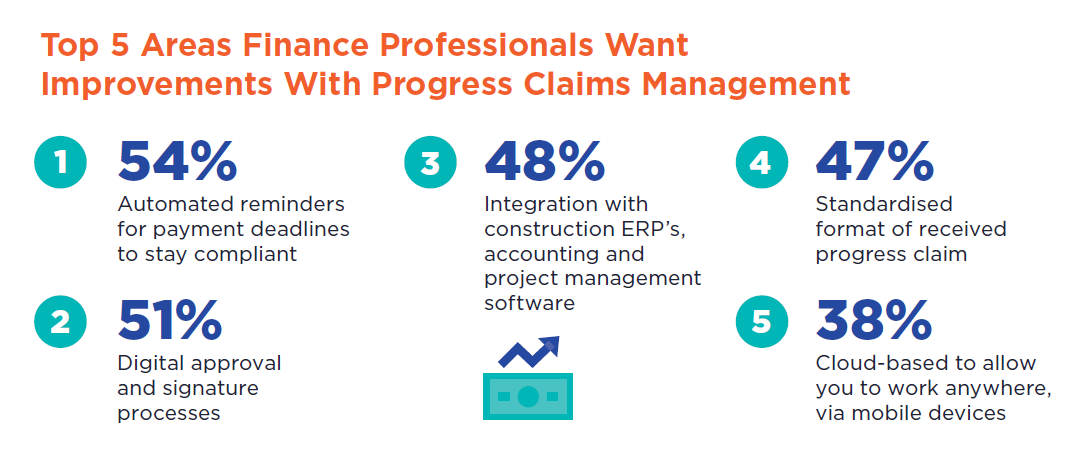

- Auto-reminders for payment deadlines

- Digital audit trails for subcontractor dispute resolutions

- Real-time dashboards showing progress claim due dates

Save Time for What Matters Most

The Challenge

- Teams not using tech spend up to 5 – 10+ hours/week on progress claims admin

- 48% manually pass claims between departments

How Payapps and Your Construction ERP Work Better Together

- Digital approvals

- Automated workflows reduce follow-ups

- Accessibility on the cloud lets teams submit and assess progress claims on and off site

The Proof: Buildcorp’s Integration Success

Buildcorp, a tier 2 contractor, integrated Payapps with their ERP (Jobpac), achieving:

- Significantly reduced admin time required to manage and process claims, from setup to approval.

- Improved real-time visibility for subcontractors and streamlined management of compliance documents, mitigating risks and delays.

- Increased project efficiency and enhanced subcontractor and client satisfaction through better communication and reliable project delivery.

“The seamless integration of Payapps with Jobpac is crucial for Buildcorp’s operations.”

– Toni Hall, Group Commercial Business Systems Manager, Buildcorp

Practical steps to integrating Payapps with your construction ERP to manage claims better

- Audit Pain Points – Identify which processes are potentially slowing you and your finance team down (Email? Spreadsheets?).

- Prioritise Key Integrations – Start rolling out integrations with your key accounting software and project ERPs to maintain data integrity.

- Train Teams on the New Workflow – 68% of Payapps users reported improved efficiency post-adoption. Make sure to follow up with training your finance teams on new processes after integrating your systems.

- Measure ROI – Track metrics like approval times and payment claim delays post-integration.

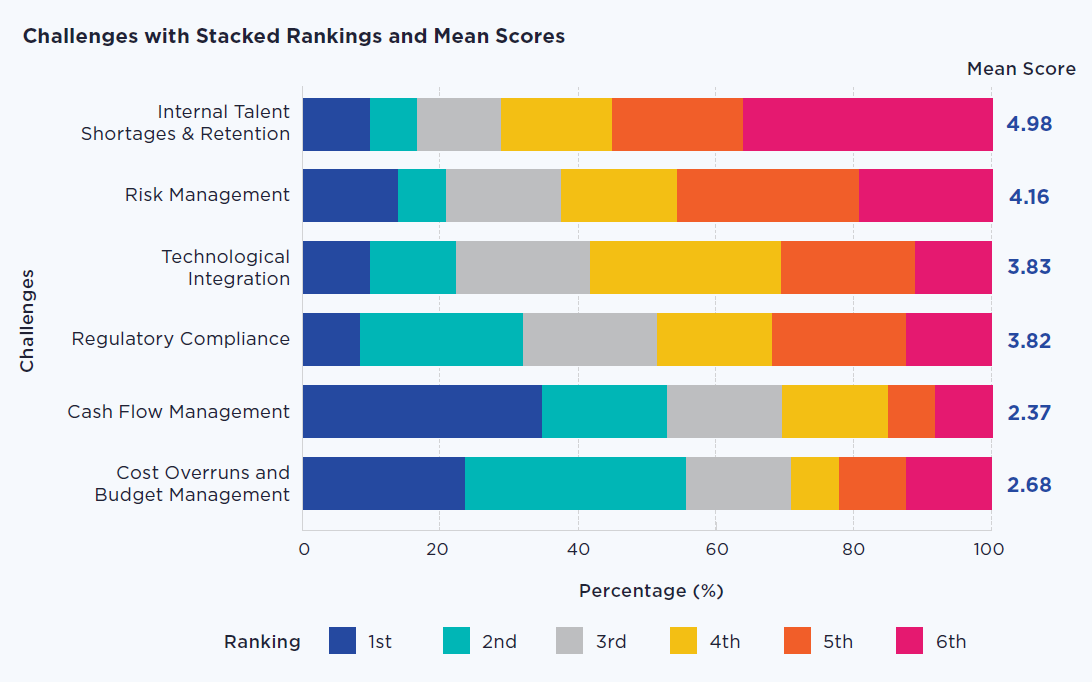

Therefore, manual administration of progress claims within disconnected systems aren’t just inefficient, they also pose real risks to your operations such as non-compliance, cash flow management, and talent retention (36% of finance teams cite retention as their #1 challenge according to our industry report).

Integrating Payapps with your construction ERP is the missing link that:

- Automates manual workflows for submitting and assessing progress claims.

- Bridges the gap between finance teams and other departments (e.g. operations, contract management).

- Future-proofs your team against potential regulatory changes.